how much federal taxes deducted from paycheck nc

Use this tool to. 95-258 a 1 - The employer is required to do so by state or federal law.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

States dont impose their own income tax for tax year 2022.

. 95-258 a 2 - The amount of a proposed deduction. Estimate your federal income tax withholding. This is true even if you have nothing withheld for federal state and local income taxes.

How do I calculate payroll taxes. Many employers will qualify for tax credits to reduce the rate to 06 by paying their state unemployment taxes on time. Median household income in 2020 was 67340.

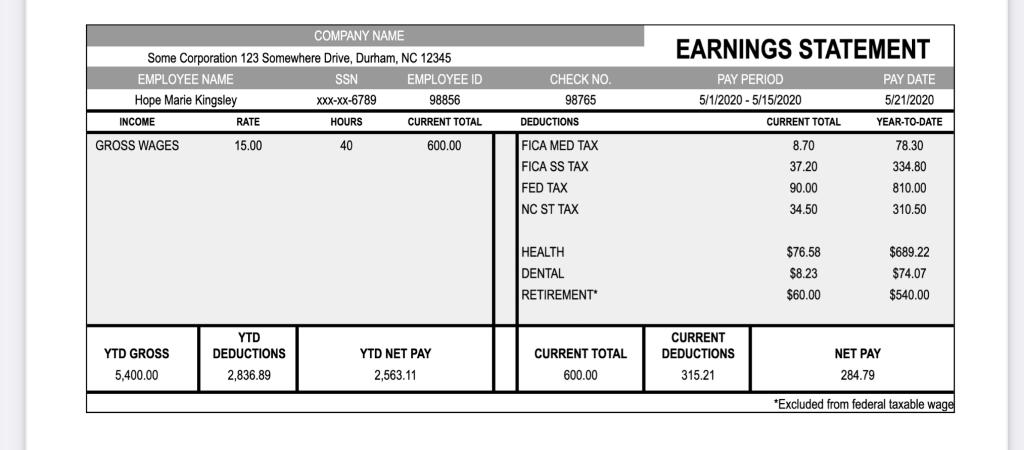

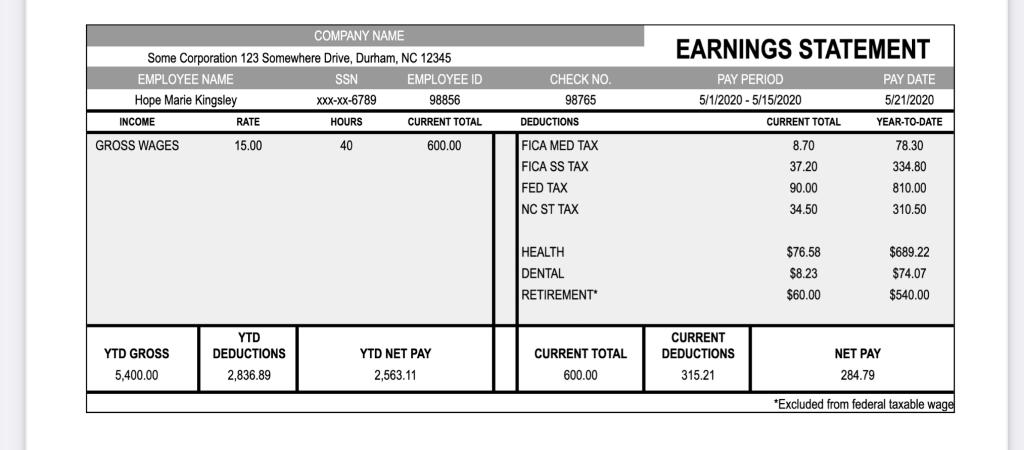

To determine each employees FICA tax liability multiply their gross wages by 765 as seen below. For 2022 its limited to 6 of the first 7000 of an employees wages each year. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax.

When you get paid in North Carolina you will notice that money has been withheld from your wages for FICA federal and state income taxes. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. Federal Income Tax Withholding.

Our online Weekly tax calculator will automatically. See how your refund take-home pay or tax due are affected by withholding amount. 95-258 Withholding of Wages an employer may withhold or divert any portion of an employees wages when.

Plus to make things even breezier there are no local income taxes. Youd pay a total of 685860 in. How It Works.

For help with your withholding you may use the Tax Withholding Estimator. The amount of income tax your employer withholds from your regular pay depends on two things. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

If you earn at least a specified amount for at least 40 quarters you can get Social Security benefits when you retire. And like North Carolina employers are solely responsible for paying FUTA tax. Each employer withholds 62 of your gross income for Social Security up to income of 132900 for 2019.

10 on the first 9700 970. The information you give your employer on Form W4. Income taxes FICA and court ordered garnishments NCGS.

North Carolina Payroll Taxes There is a flat income tax rate of 525 which means no matter who you are or how much you make this is the rate that will be deducted. For Medicare you both pay 14 percent no matter how much you make. 12 on the next 29774 357288.

Federal income tax rates range from 10 up to a top marginal rate of 37. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible. The only other thing you need to worry about is North Carolina State Unemployment Insurance.

Employee Pay Stub. North Carolina has a flat income tax rate of 525 meaning all taxpayers pay this rate regardless of. As of 2015 FICA taxes for Social Security take 62 percent of your salary up to 118500.

Census Bureau Number of cities that have local income taxes. The state of North Carolina has an income tax rate of 549 percent for the 2018 tax year. You are able to use our North Carolina State Tax Calculator to calculate your total tax costs in the tax year 202223.

If you earn more than 200000 in a year your employer must withhold an additional 09 percent for the additional Medicare tax. There is a flat income tax rate of 525 which means no matter who you are or how much you make this is the rate that will be deducted. How much is taken out of my paycheck for taxes in NC.

Federal Paycheck Quick Facts. Choose an estimated withholding amount that works for you. North Carolina income tax rate.

Your employer pays another 62 percent on your behalf. How Your North Carolina Paycheck Works. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible.

Our online Monthly tax calculator will. Your employer bases withholding on how much money you make and the number of withholding allowances you claim on form W-4 when you start work. However the 2019 tax year for taxes filed in 2020 taxpayers will see a.

Your employer then will multiply 68076 by 15 percent 10211 and add the 1680 base amount. Federal Insurance Contributions Act FICA Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. For employees withholding is the amount of federal income tax withheld from your paycheck.

Plus to make things even breezier there are no local income taxes. North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were married and filing jointly. There is a flat income tax rate of 499 which means no matter who you are or how much you make this is the rate that will be deducted.

22 on the last 10526 231572. The amount you earn. If youre single and you make 50000 after subtracting deductions exemptions etc you would pay.

2022 Federal State Payroll Tax Rates For Employers

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

D400 Form 2021 2022 Irs Forms Zrivo

North Carolina Income Tax Calculator Smartasset

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Solved Earnings Statement Company Name Some Corporation 123 Chegg Com

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Payroll Software Solution For North Carolina Small Business

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

2022 Federal Payroll Tax Rates Abacus Payroll

Here S How Rising Inflation May Affect Your 2021 Tax Bill

New Federal Tax Withholding Tables Nc Osc

North Carolina Paycheck Calculator Smartasset

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Providing Broad Based Tax Relief Grant Thornton